Maybe you have already heard about Pag-IBIG MP2 Savings but you are still unsure if you wanted to enroll for it. No worries, in this guide, you will learn about PAG-IBIG Fund's MP2, how it works and how to apply for it.

Similar to investing in mutual funds, Modified Pag-IBIG II famously known as MP2, allows members to save money and earn high dividends in addition to their regular savings. Compared to the regular PAG-IBIG savings, the MP2 program lets members have access to funds for as early as five years.

Loading...

HELPFUL ITEMS YOU CAN USE TO SAVE MONEY!

Here's my list of useful items for you to save or earn money wisely:

- Coin banks

- Informative books about money, saving and investments!

- Money organizer

Shopee is my go-to app for things I needed like the ones above. If you'd like discounts and vouchers, you may get the best offers here:

What is PAG-IBIG MP2?

The Modified Pag-IBIG II (Pag-IBIG MP2) Savings Program is a special voluntary savings facility with a 5-year maturity, designed for active Pag-IBIG Fund members who wish to save more and earn higher dividends, in addition to their Pag-IBIG Regular Savings.

Pag-IBIG MP2 Savings Benefits

The MP2 program makes saving and investing money easy, affordable, and profitable for Filipinos. If you're not sure whether to open an MP2 account, check out some basic information about the savings program:

- Budget-friendly investment - For as low as ₱500 monthly, you can invest in MP2. No penalties if you miss a contribution for certain months (though it's best to regularly remit your MP2 contributions).

- Government-guaranteed savings - You won't lose your principal since the Philippine government guarantees it.

- Tax-free dividends - Receive your MP2 dividends without tax deductions either every year or in five years.

- Up to 6% annual dividend rate - The Pag-IBIG MP2 interest rate is higher than the regular Pag-IBIG savings program and even those of bank accounts, time deposits, and other investment vehicles.

- No limit to the amount you can save - Remit as much money into your MP2 account as your budget allows. For one-time payments exceeding ₱500,000, a personal/manager's check is required.

- Multiple MP2 savings accounts - You can open as many MP2 accounts as you'd like. This is ideal if you're saving money for different goals, like emergencies, tuition, travel, retirement, etc.

- Five-year maturity period - Your MP2 savings will mature in five years, after which you can withdraw your money. This makes the MP2 savings program ideal for medium-term investment goals.

Other Pag-IBIG Fund Members Benefits

PAG-IBIG MP2 Computation

Since dividend earnings under PAG-IBIG's MP2 program are free, members will receive the full amount without paying the final 20% withholding tax. To compute your MP2 dividend, just multiply the dividend rate for the year by your monthly balance. Here’s the formula: Dividend = Dividend rate x Average monthly balance. Note that PAG-IBIG usually announces the dividend rate during the first or second quarter of the following year through its official website.

Who Can Invest Under PAG-IBIG MP2?

You qualify for the MP2 savings program if you belong to any of the following groups:

- Active Pag-IBIG Fund members with at least one monthly Pag-IBIG contribution within the last six months

- Former Pag-IBIG members with other sources of monthly income and at least 24 monthly Pag-IBIG contributions

- Pensioners, regardless of age, with at least 24 monthly Pag-IBIG contributions before retirement

- Natural-born Filipinos who reacquired their Filipino citizenship, with at least 24 monthly Pag-IBIG contributions

- Inactive members who have stopped paying Pag-IBIG contributions may enroll in MP2 by resuming their payments until they reach the minimum 24-monthly contribution requirement.

Not registered with the Pag-IBIG Fund yet? You can register online as a Pag-IBIG member and pay contributions for at least 24 months before opening an MP2 savings account.

How to Apply for Pag-IBIG MP2

You can apply for the MP2 savings program online or in person at a Pag-IBIG Fund office.

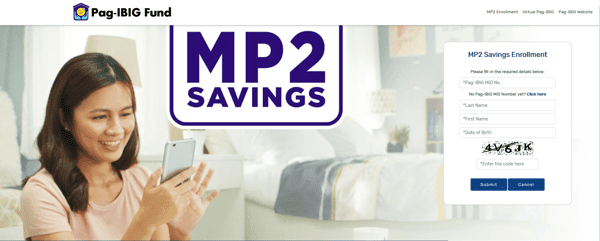

MP2 Online Enrollment Procedure

Here are the steps to applying for the MP2 savings program online:

- Visit the Modified Pag-IBIG II Enrollment page at www.pagibigfundservices.com/MP2Enrollment.

- Enter your Pag-IBIG Membership ID (MID) number, last name, first name, and birthdate (MM/DD/YYYY).

- Type the CAPTCHA code.

- Click the Submit button.

- In the Desired Monthly Contribution field, enter the amount you wish to remit every month for your MP2 savings.

- Select your preferred option from the following dropdown menus:

- Preferred Dividend Payout: Whether you'd like to receive your MP2 dividends every year or by the end of the five-year term

- Mode of Payment: Whether you prefer to pay your MP2 contributions through salary deduction, over-the-counter at any Pag-IBIG branch, or through any Pag-IBIG Fund-accredited collecting partners

- Source of Funds: Your main income source where your MP2 payments will come from

- Click the Submit button.

- Your completed Modified Pag-IBIG II Enrollment Form will be displayed, which contains your 12-digit MP2 savings account number. You may save this form as a PDF file or print it.

ATTRACTIONS TO SEE IN MANILA

Klook.comMP2 Manual Enrollment Procedure

If you have other transactions you need to complete at the nearest Pag-IBIG office, then you might as well open your MP2 savings account there. Make sure to check the Pag-IBIG office's operating hours as they can change anytime.

Pag-IBIG MP2 Requirements

Simply submit the following documents for your MP2 application:

- Valid ID

- Accomplished Modified Pag-IBIG II Enrollment Form

- ATM card or passbook of your bank account where you'd like to receive your MP2 savings and dividends

How to Invest in the MP2 Program

As soon as you're done with your MP2 enrollment, you can start saving under the investment program. You can either make a one-time lump sum payment or a monthly contribution of smaller amounts to your MP2 savings account.

Modes of Payment

There are three major ways to pay your MP2 contribution:

- Salary deduction by your employer

- Personally at any Pag-IBIG branch

- Or through any accredited collection partner

For employees, the best Pag-IBIG MP2 mode of payment is through salary deduction, as MP2 savings are automatically deducted from the salary and remitted to the MP2 account.

For freelancers, entrepreneurs, and unemployed Pag-IBIG members, the most convenient payment mode is through third-party payment channels, especially online facilities.

ACTIVITIES AND TOURS IN MANILA

Where to Pay Your MP2 Contributions

Over-the-Counter Payment Centers:

- Bayad Center

- ECPay

- M. Lhuillier

- SM Business Centers, including Savemore and SM Hypermarket bills payment counters

Online Payment Channels:

Whatever online payment facility you use, choose Modified Pag-IBIG 2 as your payment type and provide your MP2 account number.

How Can I Check My MP2 Online?

You may monitor your posted MP2 contributions through Virtual Pag-IBIG. But before you can do that, you have to create a Virtual Pag-IBIG account first.

|

| Virtual Pag-IBIG |

After your Virtual Pag-IBIG account is activated, you can already verify your MP2 savings online. Here's how.

- Log in to your Virtual Pag-IBIG account.

- On the left menu, select MP2 Savings under the Products tab.

- View your MP2 contribution payments on the screen.

MP2 Savings Program FAQs

1. How much is the Pag-IBIG MP2 contribution?

The minimum amount you can save in your MP2 account is ₱500 per month. This makes Pag-IBIG's savings program one of the most affordable for Filipinos who want to start investing small.

2. Where are contributions invested?

MP2 contributions paid by Pag-IBIG members are invested in Pag-IBIG housing loans (which earn interest paid by member-borrowers), government securities, and corporate bonds. Investing money in fixed securities makes the MP2 a less risky investment compared to stocks and other high-risk instruments.

3. How much dividends will I earn from my MP2 savings?

The annual MP2 dividends you'll receive will depend on the dividend rate set by Pag-IBIG for a particular year during your investment term. The annual rates vary depending on Pag-IBIG Fund’s financial performance and other factors.

According to a sample MP2 computation at the Pag-IBIG website, if you've been saving ₱500 from 2020 to 2024, you're likely to receive a total dividend of ₱5,718.75 (if you chose to get your dividends annually). Your total dividend will be higher (₱6,266.14) if you opt to get paid the lump sum after your MP2 account's five-year term.

4. What is the interest rate of MP2 in Pag-IBIG for 2022?

The final MP2 dividend rate for 2022 hasn't been announced yet as of this writing. But for 2021, it was 6%.

5. How will I receive my MP2 dividends?

You can claim your MP2 Savings after its five-year maturity through the Virtual Pag-IBIG facility. You can also claim it in person. Fill out the Application for Provident Benefits form[8] and submit it to the nearest Pag-IBIG Fund branch.

6. Can I withdraw my MP2 savings before its maturity?

Ideally, like in other investments, it's best to just let the funds in your MP2 account grow until your account matures. This way, you get to maximize your profits.

However, an unfortunate life situation might make withdrawing your MP2 savings necessary. The Pag-IBIG Fund allows early withdrawal under any of the following scenarios:

- Total disability or insanity

- Termination from employment due to health reasons

- Death/critical illness of the MP2 account holder or an immediate family member

- Retirement

- Migration to another country

- Unemployment due to layoff or company closure

- OFW repatriation from the host country

You may withdraw your savings for a reason other than those allowed by Pag-IBIG. But you'll only receive half of the total dividend earned (if you chose to receive dividends after five years) or only your contributions (if you chose the annual dividend payout option).

7. Can I enroll a new MP2 savings account after maturity?

Yes, you can open new MP2 savings accounts once your existing account matures. This is a good strategy if you wish to invest your money in the long term, like for retirement.

8. What will happen if I don't claim my dividends?

Unclaimed MP2 savings after the five-year maturity will keep on earning dividends (based on the dividend rates of the Pag-IBIG Regular Savings Program). After two years, it will no longer earn dividends. You should just withdraw your contributions.

No comments

Let us know your thoughts!